Real-Time Settlement Dashboards Are Changing Claims Administration for Good.

Process millions of claims without fragmentation, detect fraud in real-time, and increase successful distributions

Information has always been power. But until recently, that power came with significant limitations: delayed reporting, fragmented data sources, and a reactive approach to distribution management.

Today, real-time visibility through modern settlement dashboards is changing how administrators operate - and the results speak for themselves.

The Blind Spots in Traditional Settlement Administration

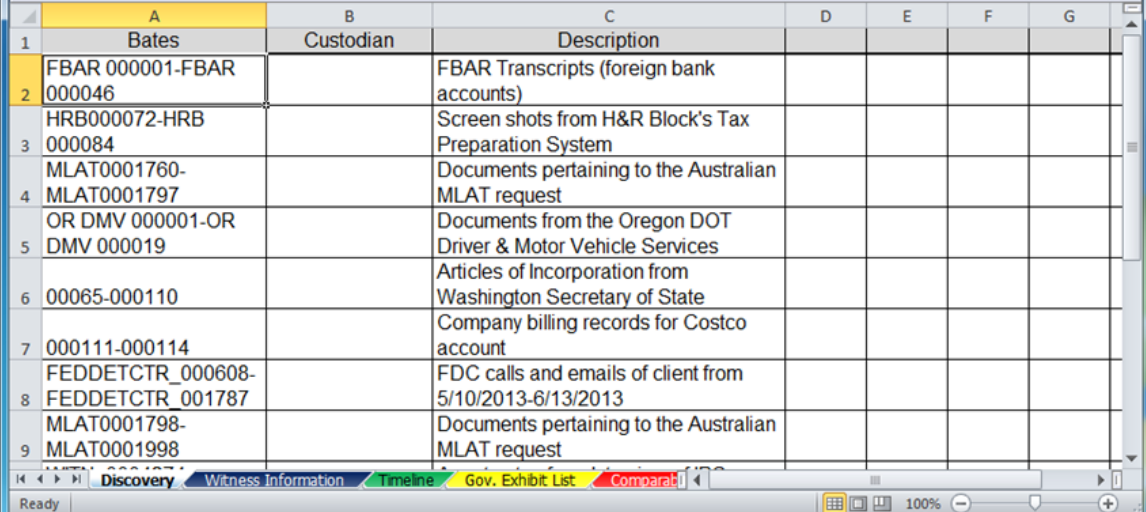

Traditional settlement distribution has relied on a patchwork of systems that rarely communicate effectively with each other:

- Claims processing platforms track submission data but often lack integration with payment systems

- Payment providers process transactions but offer limited visibility into fulfillment status

- Accounting systems reconcile funds but struggle to connect payment events with claimant records

- Reporting tools generate insights - but typically days or weeks after key events occur

Beyond these system disconnects, administrators face mounting challenges with data volume and fraud detection.

Traditional data tools like Excel and Google Sheets severe inherent limitations, with row limits of roughly 1 million rows per file. This presents a significant challenge when handling bulk claims that must be exported from SQL databases for visual review. Administrators are forced to split data into multiple files, leading to disjointed and inconsistent reviews.

This fragmentation creates a breeding ground for errors, particularly in duplicate claim detection.

According to recent reports, more than 80 million claims submitted in 2023 showed significant signs of fraud - a staggering 19,000% increase from just two years earlier. Modern administrators must be prepared to process and validate claims submitted at rates of 10+ per second while maintaining data integrity.

The Dashboard Difference: From Reactive to Proactive Management

Modern settlement administration platforms with integrated dashboards are eliminating these blind spots.

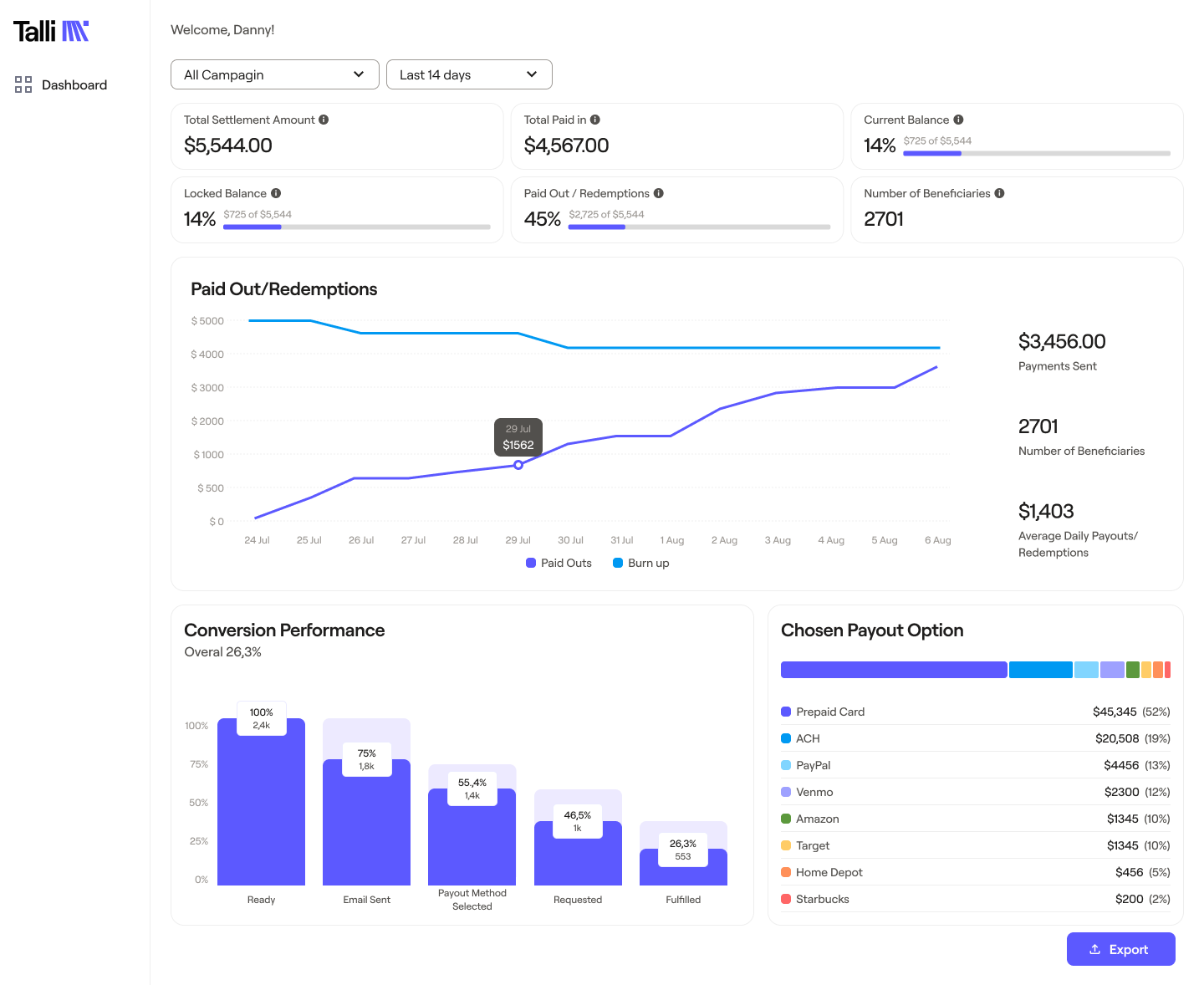

With Talli's unified dashboard approach, administrators gain:

1. Complete Claimant Journey Visibility

Monitor each claimant's progress from claim submission through payment selection, processing, and redemption - from a single interface. This end-to-end visibility enables administrators to identify bottlenecks before they become problems.

2. Real-Time Payment Method Analytics

Track which payment methods claimants are selecting and their redemption rates across different demographics. This intelligence allows for data-driven decisions about which payment options to emphasise for specific claimant populations.

3. Instant Notification of Exceptions

Rather than discovering failed payments days later, receive immediate alerts when transactions are declined or when claimants encounter issues. This rapid response capability can dramatically improve redemption rates.

4. Compliance Documentation Automation

Auto-generate audit trails and compliance documentation as events occur, rather than reconstructing them after the fact. This not only saves time but substantially reduces compliance risk.

Case Study: How Real-Time Visibility Transformed Strategic Settlement Management

For a recent consumer protection settlement involving 25,000 claimants, a leading claims administrator leveraged Talli's dashboard to transform their distribution process:

- Identified and resolved payment processing issues within hours instead of days

- Tracked claimant payment preferences in real-time, enabling targeted outreach to non-responsive claimants

- Provided the court with instant status updates during distribution

- Reduced reporting preparation time significantly

But the impact is beyond monitoring. The dashboard became a strategic decision-making tool through advanced features including:

- Predictive analytics that forecast final redemption rates based on early response patterns

- Anomaly detection to flag unusual patterns potentially indicating fraud

- Proactive follow-up systems that ensured claimants actually redeemed their payouts

This visibility across the entire claims lifecycle allowed administrators to handle large datasets without fragmentation and validate claims in real-time.

For those still operating with fragmented systems and delayed reporting, the question isn't whether to upgrade to dashboard-driven visibility - it's how quickly they can make the transition before falling behind.

To learn more about how Talli's real-time dashboard is transforming settlement administration, schedule a 15-minute demonstration today.