The Hidden Operational Costs of Traditional Settlement Payments

A single uncashed settlement check costs administrators an average of $150 to track, reissue, and reconcile.

Now multiply that by thousands of checks per settlement.

The true cost of managing class action payments extends far beyond the visible expenses. Recent settlements reveal a complex web of operational burdens that drain resources and delay distributions. Here's what the data tells us about these hidden costs.

The Check Problem Nobody Talks About

Up to 30% of settlement checks never reach their intended recipients. In the recent Visa Mastercard $5.54B settlement, this means hundreds of millions in payments requiring additional processing

Each uncashed check triggers a cascade of expenses:

- Bank fees for stop-payments

- Staff time for payment tracking

- Physical costs for printing and mailing

- Storage fees for returned mail

- Resources for recipient outreach

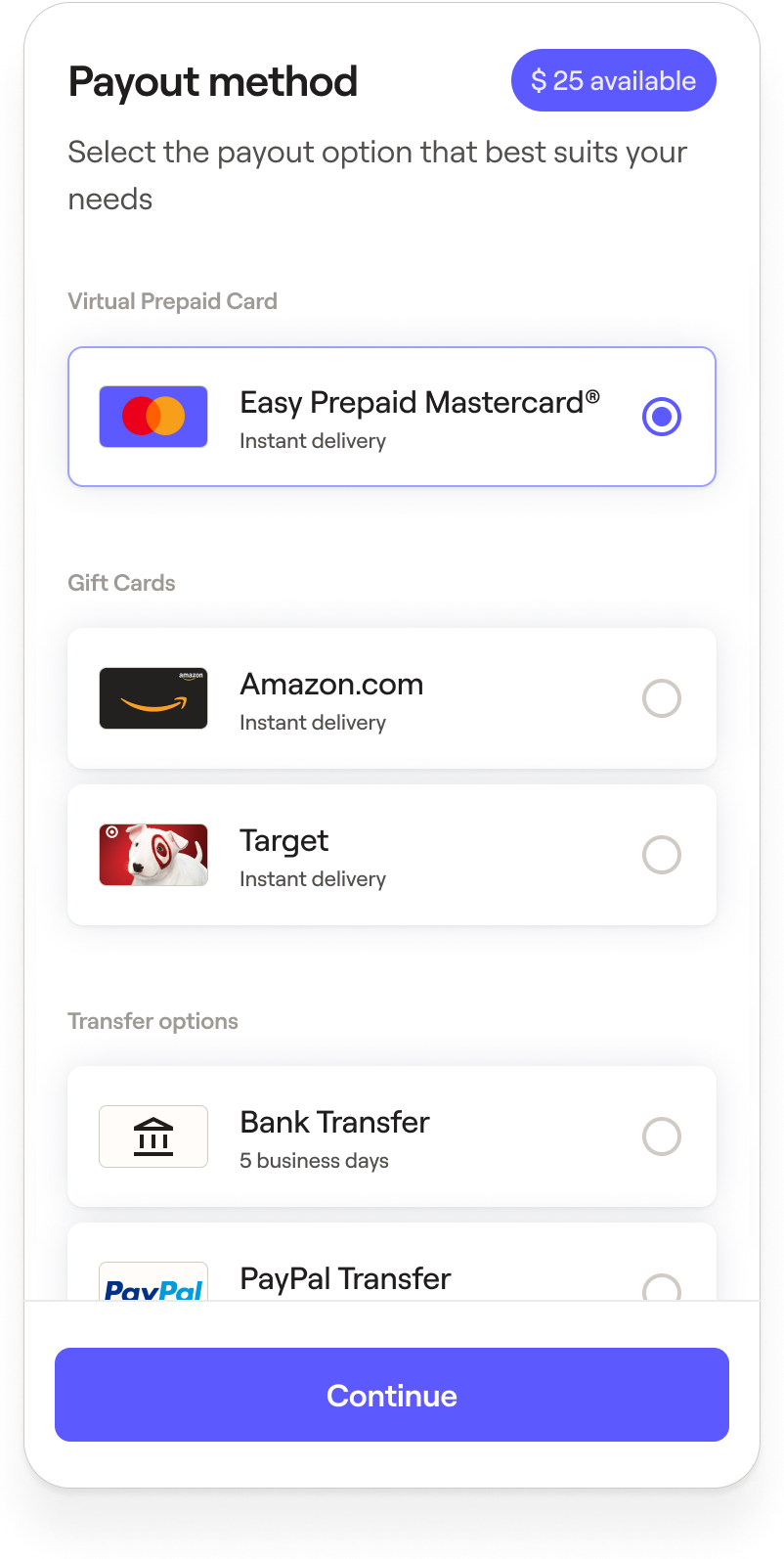

Modern digital payment platforms have shown that offering multiple payment options – from prepaid cards to digital wallets, provides a payment solution for both banked and unbanked claimants can reduce uncashed payment rates dramatically. When claimants choose their preferred payment method, successful distribution rates improve significantly.

When Compliance Meets Complexity

Modern settlements face unprecedented scrutiny. Take the recent 1.4M member data breach case: administrators had to document contact attempts for 90% of class members through mail and email. The paper trail doesn't end there.

The $2.8B Blue Cross Blue Shield settlement demonstrates how compliance documentation has evolved. Multi-year oversight requirements mean maintaining detailed records of every payment attempt, response, and redistribution effort.

Fund segregation and real-time tracking technologies are changing this landscape.

For example, Talli advances this transformation through three key capabilities: real-time tracking of claimant interactions, individual fund segregation with detailed settlement engagement records, and comprehensive digital auditing of the entire campaign.

When payment platforms maintain clear ownership records throughout the disbursement process, reporting becomes automated and transparency increases naturally.

Manual Processes in a Digital Age

Real cases highlight the growing administrative burden:

A Nebraska student loan settlement required staff to manually process 123 late-filed claims. These late claims represented $597,000 in additional damages to be included in the settlement.

Similarly, the $35M iPhone 7 settlement needed teams verifying individual device defects. Walmart's $45M overcharging case showed how legacy systems buckle under high-volume processing.

AI-enabled platforms are now automating many of these manual tasks, from payment processing to customer support inquiries. Self-service dashboards allow administrators to manage distributions without extensive manual intervention.

Technology: Help or Hindrance?

Settlement administrators face a technology paradox. They need modern systems to handle increasing volumes, but integration with legacy platforms creates new challenges:

- Multiple systems that don't communicate.

- Ongoing maintenance of outdated technology.

- Growing security requirements

- Constant upgrade cycles

Cloud-based payment platforms are addressing these challenges through scalable infrastructure and modern APIs. Talli's API empowers Class Administrators to orchestrate campaign setup and execution while pulling real-time information into their operational CRM, providing a 360-degree view of claimants throughout the distribution process. When payment systems integrate seamlessly with existing processes, technology becomes an enabler rather than a barrier.

What This Means for Settlements

With $42B in settlements recorded in 2024 and 19 state privacy laws to navigate, traditional payment methods no longer meet modern demands. Recent data breach cases involving millions of class members prove that even updated notification systems can't fully address distribution inefficiencies.

These hidden costs directly impact outcomes:

Distribution timelines stretch. Administrative overhead grows. Error rates increase. Payment success rates drop. Court reporting becomes more complex.

The future of settlement administration lies in digital-first platforms that combine payment innovation with compliance-ready infrastructure. By automating manual processes, providing real-time tracking, and offering multiple payment options, modern systems transform settlement administration from a cost center into an efficiency driver.