Settlement Administration in a Digital-First World

How To Meet Modern Claimant Expectations

Settlement administration is undergoing a transformation. Today, claimants no longer compare their settlement experience to other legal processes - they compare it to every digital service they use daily, from banking apps to food delivery platforms.

The Evolution of Claimant Expectations

According to recent industry research, 81% of customers expect faster service as technology advances. This expectation extends to all industries, including legal services and settlement administration.

While consumers can instantly transfer money, track packages in real-time, and access customer service via chat at any hour, many still receive settlement payments through paper checks that take weeks to arrive with little visibility into the process.

This disconnect affects how claimants perceive the legitimacy and professionalism of the entire legal process.

The Data Behind Digital Transformation

Organisations that have embraced digital-first approaches have seen remarkable results:

The UK's Online Civil Money Claims service reduced average case resolution from 30 weeks (paper-based) to just 8 weeks through digital workflows.

Settlement administrators using Talli have experienced similar transformations.

One administrator managing a 25,000-claimant settlement saw their distribution timeline compress from six weeks to just 2 days, while simultaneously increasing take up rates by over 30%.

What Claimants Actually Want

Immediacy and Control

Modern consumers expect not just speed but control over when and how they receive information and payments:

- Immediate access to funds, not weeks of waiting for checks

- Self-service options for checking status and selecting preferences

- Mobile-friendly interfaces that work on any device

Talli's platform addresses these needs through instant digital payments, a self-service claimant portal, and real-time status updates - changing how claimants experience the settlement process.

Transparency and Payment Options for All

A significant 82% of U.S. consumers express concerns about how companies handle their personal data. In settlement administration, claimants want clear visibility into their claim status and payment timing.

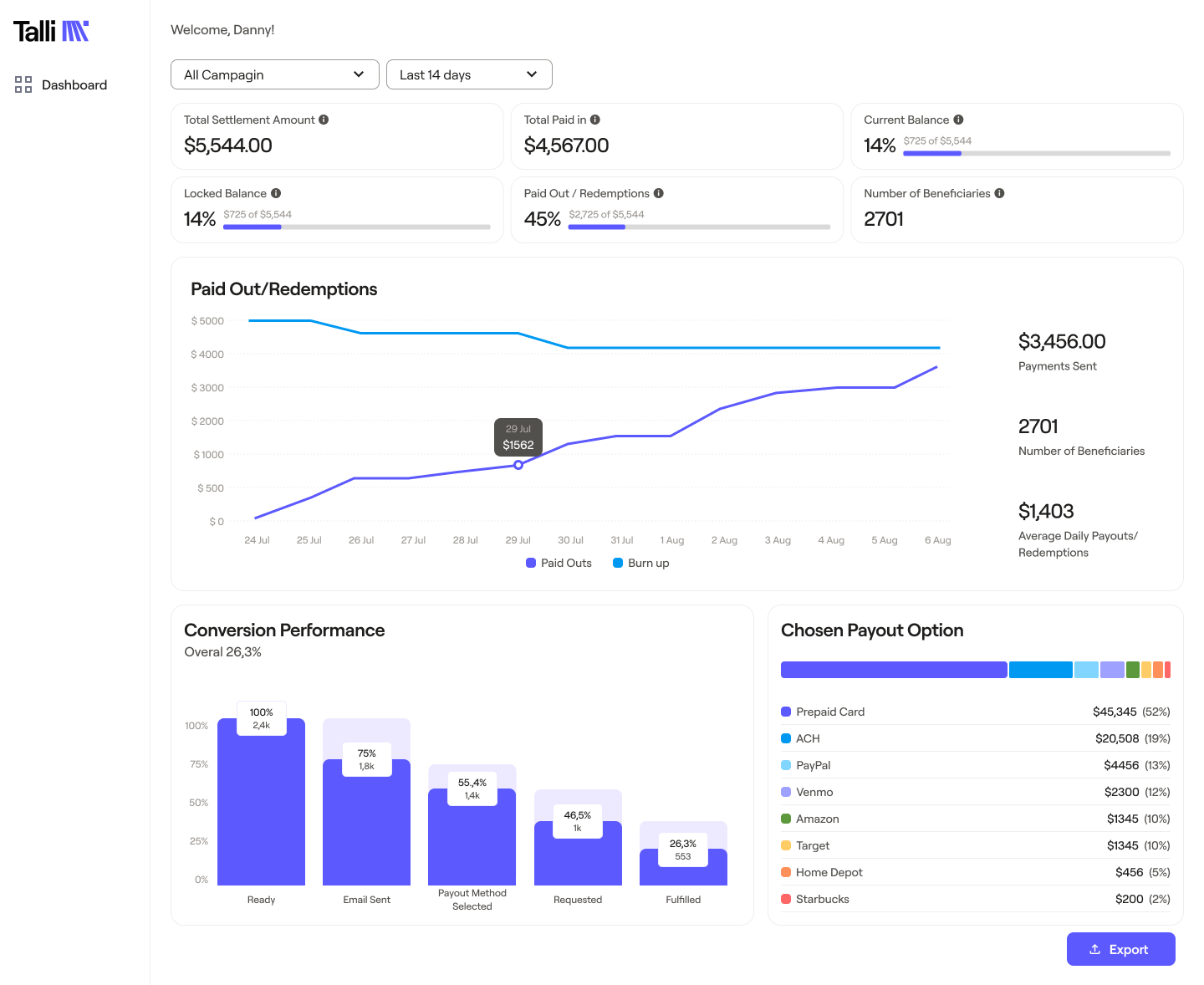

Talli's real-time dashboard solves this by providing administrators and claimants with complete transparency.

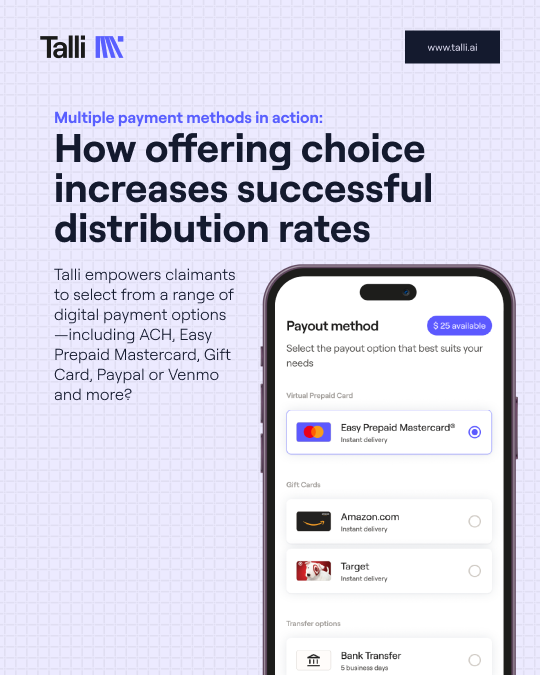

Perhaps most importantly, claimants expect payment options that fit their specific needs.

Recent data shows a pronounced shift toward digital payment methods among younger demographics, yet significant portions of the population still prefer or require traditional methods.

A unified payment approach bridges this gap by offering multiple payment options through a single platform.

Unlike traditional systems that force administrators to choose between digital efficiency and universal access, Talli delivers both - ensuring high redemption rates across all demographic groups.

How Talli is Transforming Settlement Administration

Talli's platform represents a fundamental reimagining of settlement administration infrastructure:

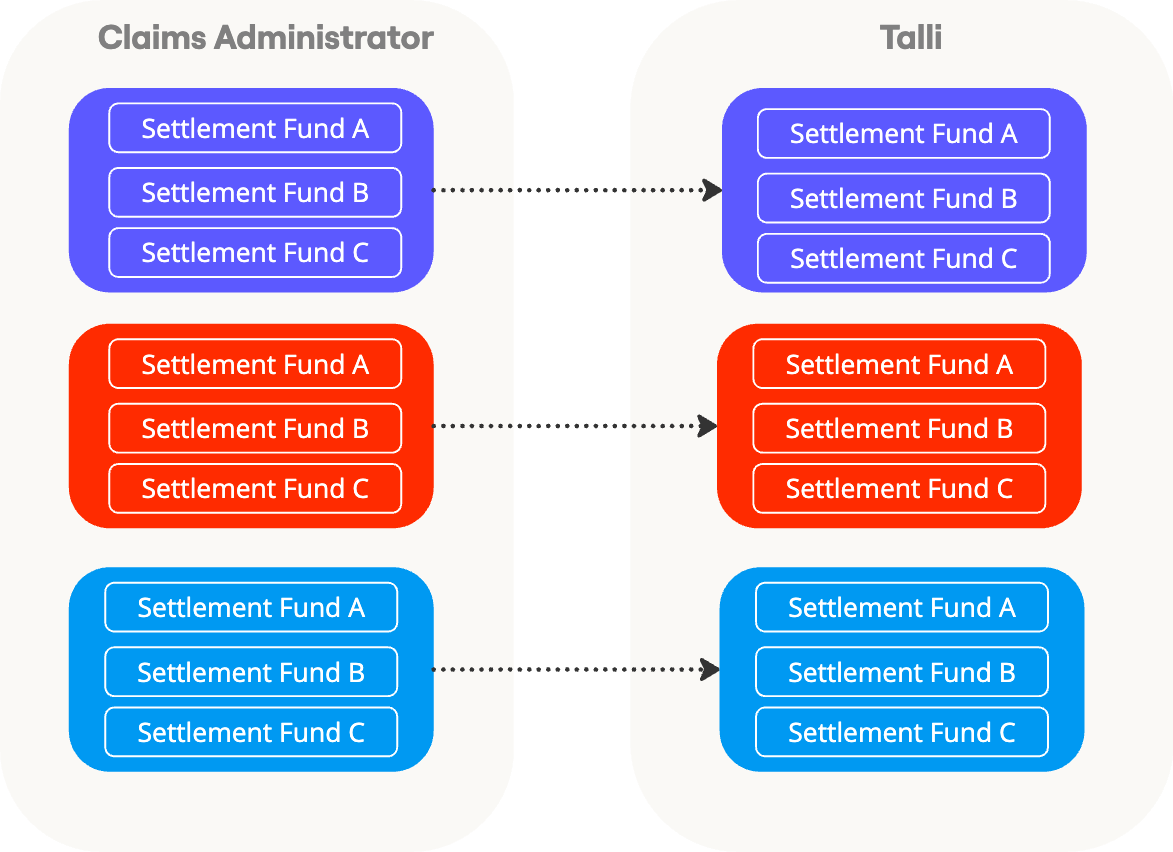

Complete Fund Segregation: No compromise of QSF ownership during distribution, Talli maintains proper fund segregation throughout the entire process using QSF-specific FBO accounts with unique sort codes and Tax IDs.

Digital-First, Not Digital-Only: Balances modern efficiency with universal accessibility, offering digital methods while ensuring no claimant is left behind.

Unified Dashboard: Real-time analytics provide administrators with immediate visibility into distribution progress, identify bottlenecks, and enable proactive management of exceptions.

Fraud Prevention: Advanced fraud detection identifies suspicious patterns in real-time, protecting settlement integrity in an era where fraudulent claims have increased by 19,000% since 2021.

The Path Forward

The shift to digital-first settlement administration is a realignment with modern claimant expectations.

As settlement administration continues to evolve, combining payment innovation, compliance expertise, and user-centered design to deliver experiences that feel natural and appropriate to today's consumers can also achieve remarkable operational efficiencies.