Secure Fund Segregation

The Foundation of Reliable Settlement Distribution

In Class Action Settlements, fund segregation isn't just a best practice—it's a fundamental requirement. These settlement funds are so distinct that they receive their own tax ID through a Qualified Settlement Fund (QSF), acknowledging that the money belongs to the claimants, not the administrators.

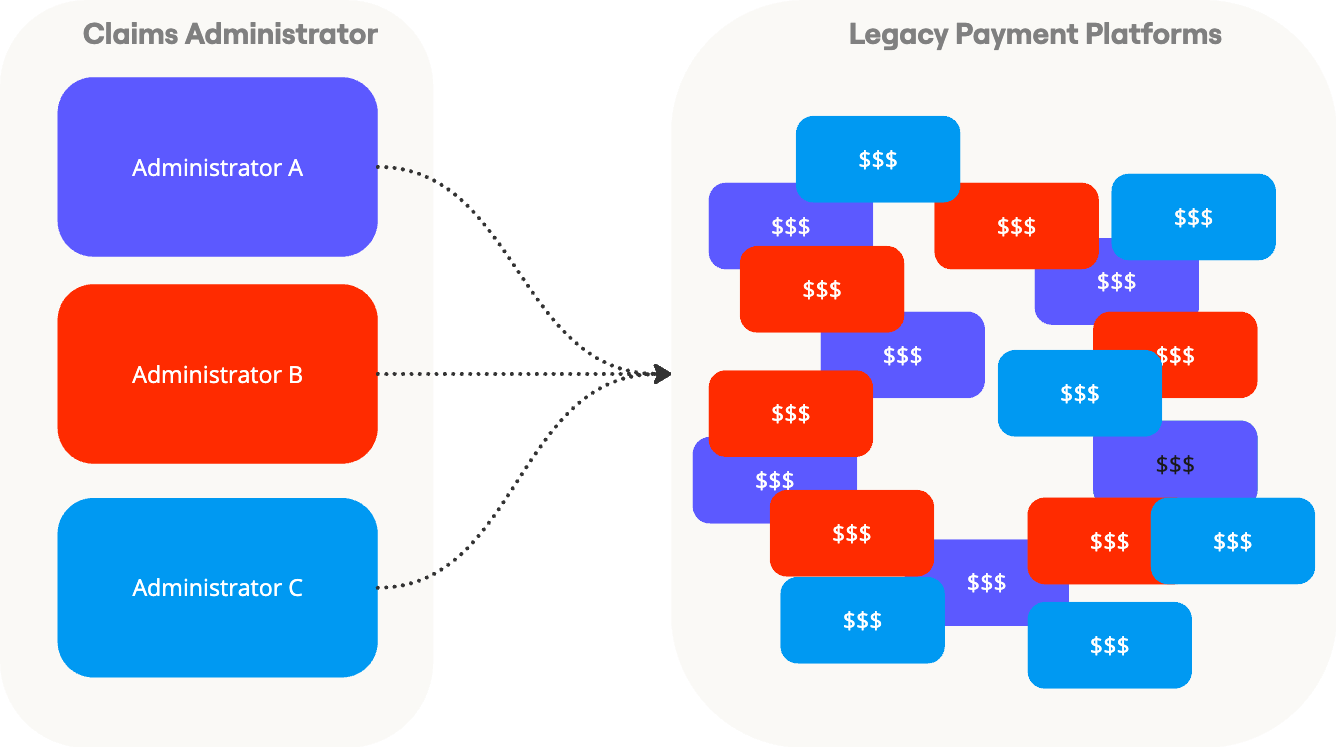

The Challenge of Maintaining Fund Ownership

Maintaining proper fund ownership throughout the settlement process has historically been complex. As settlement funds move through various stages of disbursement, ensuring they remain under QSF ownership is crucial for compliance and transparency. This challenge becomes particularly acute when using third-party digital payment providers for settlement fund disbursement, as the traditional payment infrastructure often requires transferring ownership of funds to facilitate payments.

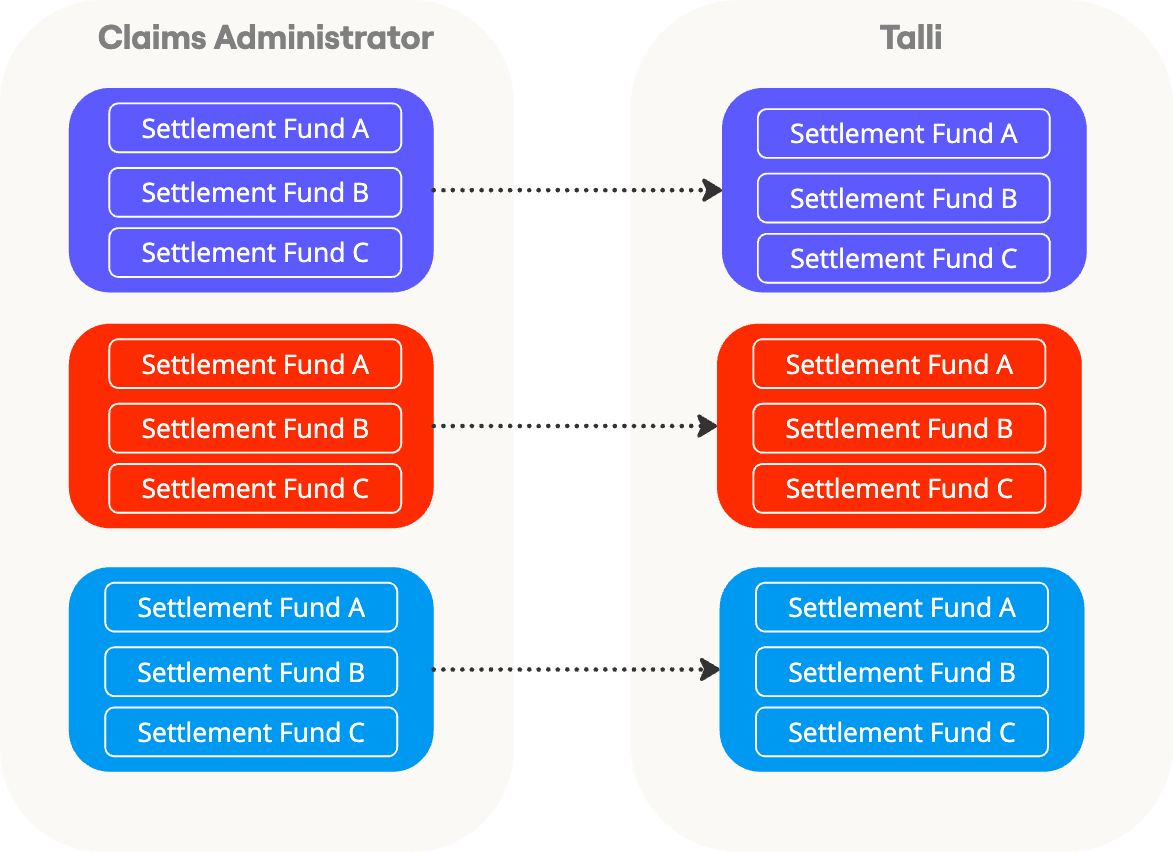

Talli's Innovation in Fund Segregation

We've engineered our platform to maintain QSF ownership throughout the entire payment lifecycle. Our solution creates QSF-specific segregated FBO (For Benefit Of) bank accounts, each with unique sort codes and account numbers. Tax Identification Numbers can be assigned to ensure lineage throughout the disbursement process. Claims Administrators can establish multiple FBO accounts based on their specific requirements, ensuring complete separation of funds across different settlements.

Enhanced Visibility and Control

Our platform provides unprecedented transparency into settlement campaign performance. Claims Administrators can track:

- Individual claimant redemption status

- Selected payout options

- Payment fulfilment timing

This granular visibility enables Claims Administrators to provide detailed reporting to law firms and judges, setting realistic expectations and demonstrating the effectiveness of settlement campaigns.

Why This Matters

By maintaining strict fund segregation and providing detailed tracking capabilities, we're helping Claims Administrators fulfil their fiduciary responsibilities while streamlining the settlement process. This approach ensures compliance, enhances transparency, and provides the detailed oversight necessary for successful settlement distribution.